The Sad 6: States with the Worst Housing Markets

The dream that was once considered the birthright of Americans — a lifelong career, a family, a nice house — is a dream deferred for many. Although median home prices are seeing double-digit growth in the areas that were hardest hit in the housing bust, seven years after the Great Recession began, many homeowners are still dealing with housing troubles.

This year the 30-year fixed-rate mortgage has averaged 4.34 percent, according to HSH.com. In 2007, the average 30-year fixed-rate mortgage was 6.58 percent. Many struggling homeowners have not been able to take advantage of the lowest rates in history to refinance due to an underwater property, too much debt, unemployment or a low credit score.

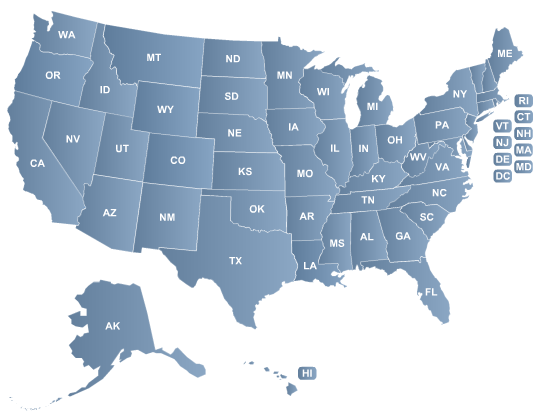

So where are the homeowners with the biggest problems? WisePiggy.com has identified “The Sad 6”, the six states that have the highest rates of foreclosure, short sales, and underwater properties. Using current data provided to WisePiggy by RealtyTrac and Equifax, we conducted a careful analysis to see which states have still not recovered after hitting rock-bottom.

The data points WisePiggy focused on were: the states with the highest foreclosure rates, the highest percentage of underwater mortgages, and the states with the highest percentage of short-sale homes. RealtyTrac defines “seriously underwater” as “the combined loan amount secured by the property is at least 25 percent higher than the property’s estimated market value.” WisePiggy utilized a weighted average system to score each of the 50 states as well as the District of Columbia to rank the states.

The map below indicates how all states (and Washington, D.C.) ranked in the study, from worst (no. 1) to best (no. 51):

Here are the worst of them all:

1. Florida

Number of foreclosures occurred in July 2014: 1 in every 469 homes

Percentage of homes currently seriously underwater: 30%

Percentage of short sales: 10.8%

Florida leads the nation with the highest rate of foreclosures … again. Although this statistic has been showing improvement over the recession years (in 2010 it was 1 in 17 homes), the number of homeowners continuing to face foreclosure is still incredibly high.

2. Nevada

Number of foreclosures in July 2014: 1 in every 639 homes

Percentage of homes currently underwater: 32%

Percentage of short sales: 9.0%

The most alarming statistic regarding Nevada’s housing market is certainly the percentage of homes that are seriously underwater. Refinancing an underwater mortgage is nearly impossible. Unless you are willing to take a serious hit to your investment and credit score and move forward with a short sale, foreclosure may be the only option. Nevada’s high underwater rate may foreshadow an increase in foreclosures in the coming months.

3. Illinois

Number of foreclosures in July 2014: 1 in every 747 homes

Percentage of homes currently underwater: 30%

Percentage of short sales: 7.7%

Illinois’s underwater problem is nearly as bad as Nevada’s. In January 2014, 32 percent of homes were categorized as “seriously underwater,” and in January 2013, it was 35 percent. The year-over-year decrease of underwater homes is a good sign; however, the change has not been rapid enough to avoid landing a spot in the top three worst housing markets in all of the U.S.

4. Maryland

Number of foreclosures in July 2014: 1 in every 553 homes

Percentage of homes currently underwater: 21%

Percentage of short sales: 6.4%

With neighbors Washington, D.C., and Virginia ranking No. 44 and No. 37, respectively, in our survey, it may be a surprise to find Maryland in the Sad 6, The data tell the tale: Maryland has the second highest rate of foreclosures in the nation, trailing Florida by only a small margin. The smaller percentage of underwater homes and short sales keeps Maryland from rising to the top three on our list of poor housing markets, but the overall market in Maryland is still glum.

5. Ohio

Number of foreclosures in July 2014: 1 in every 839 homes

Percentage of homes currently underwater: 26%

Percentage of short sales: 4.2%

The average home listing price in Ohio is approximately $116,100, according to Zillow.com, which makes the state one of the nation’s lowest cost areas to live in. The low cost of living blended with the above average foreclosure rate and high percentage of underwater mortgages paints a vivid picture of an economy struggling to overcome the recession. Unfortunately there doesn’t appear to be an end: RealtyTrac predicts Ohio’s foreclosure rate will increase in the coming months.

6. Delaware

Number of foreclosures in July 2014: 1 in every 948 homes

Percentage of homes currently underwater: 20%

Percentage of short sales: 4.5%

Delaware leads the nation in the shortest foreclosure process; its average foreclosure time frame is about 170 days. The quick process of foreclosure in the Diamond State may be the reason why the underwater mortgage percentage is relatively low for our top six.

On the flip side of the coin, there are many states within the United States where housing markets are shining. In fact, states like North Dakota only see one foreclosure in every 159,734 homes. If you haven’t checked out the map already here is a quick list of the Happy 6: The states with the best housing markets.

- South Dakota

- North Dakota

- Montana

- West Virginia

- Vermont

- Mississippi